Taxes off paycheck

This was called the Hall Income Tax after Sen. Sometimes referred to as the hospital insurance tax this pays for health insurance for people who are 65 or older younger.

Here S How Much Money You Take Home From A 75 000 Salary

IR-2019-178 Get Ready for Taxes.

. New York Paycheck Quick Facts. In fact your employer would not withhold any tax at all. For a single filer the first 9875 you earn is taxed at 10.

PENALTYucator - Late Filing Payment Penalties. The money also grows tax-free so that you only pay income tax when you. The income tax rebate calls for a single person to receive 50 while those who file taxes jointly are poised to receive a total of 100 Mendozas office said in a news release.

See how your refund take-home pay or tax due are affected by withholding amount. Your bracket depends on your taxable income and filing status. You pay the tax on only the first 147000 of your.

Frank Hall the senator who. Your average tax rate is. That means that your net pay will be 37957 per year or 3163 per month.

Estimate your federal income tax withholding. Use this tool to. 10 12 22 24 32 35 and 37.

Montana Individual Income Tax Return Form 2 2021. However making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. Prior to 2021 Tennessee levied a flat tax on income earned from interest and dividends.

Census Bureau Number of cities that have local income taxes. EITCucator - Earned Income Tax Credit. The same goes for the next 30000 12.

Census Bureau Number of cities that have local income taxes. If youre considered an independent contractor there would be no federal tax withheld from your pay. Federal income taxes are paid in tiers.

These are the rates for. That means that your net pay will be 43041 per year or 3587 per month. The changes to the tax law could affect your withholding.

From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. Withholding is the amount of income tax your employer pays on your behalf from your paycheck. If this is the case.

New York income tax rate. There are seven federal tax brackets for the 2021 tax year. How much is the Medicare tax.

How Your Washington Paycheck Works. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

The state tax year is also 12 months but it differs from state to state. Montana Individual Income Tax Return Form 2 2020. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

Get ready today to file 2019 federal income tax returns. STATucator - Filing Status. Washington income tax rate.

Your average tax rate is. Whether your taxable income is 40000 a year 400000 or 40 million the first 10000 you earn is taxed the same 10. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Some states follow the federal tax. Taxpayers can help determine the right amount of tax to.

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Mathematics For Work And Everyday Life

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

The Measure Of A Plan

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

How To Calculate Taxes Using A Paycheck Stub The Motley Fool

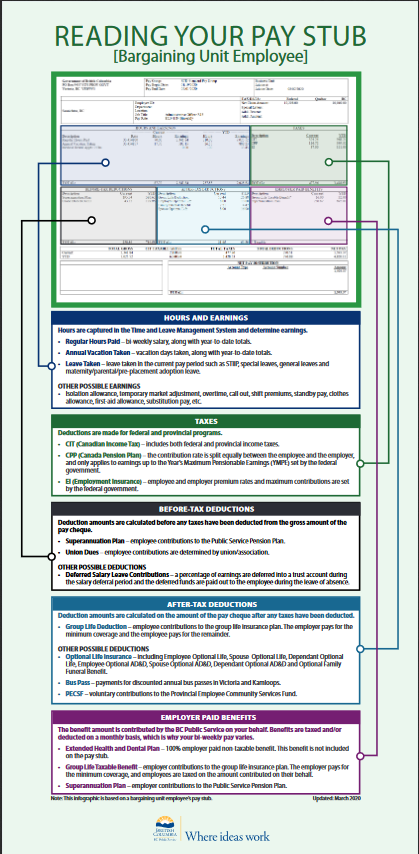

How To Read Your Pay Stub Province Of British Columbia

Mathematics For Work And Everyday Life

Pay Stub Meaning What To Include On An Employee Pay Stub

How To Calculate Payroll Tax Deductions Monster Ca

Paycheck Calculator Online For Per Pay Period Create W 4

Paycheck Taxes Federal State Local Withholding H R Block

How Much Money Is Taken Of My Paycheck Part Time Job At A Grocery Market Chain In Ontario Canada Quora

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Free Online Paycheck Calculator Calculate Take Home Pay 2022

The Measure Of A Plan