Calculate diminishing value depreciation

Calculate My Estimated Depreciation. In accountancy depreciation refers to two aspects of the same concept.

How To Calculate Depreciation Youtube

However if its a student doing an academic project you can use the straight-line method.

. First the actual decrease of fair value of an asset such as the decrease in value of factory equipment each year as it is used and wear and second the allocation in accounting statements of the original cost of the assets to periods in which the assets are used depreciation with the matching principle. Pages 550 words Approximate price. Economic value added EVA is the economic profit Economic Profit Economic profit refers to the income acquired after deducting the opportunity and explicit costs from the business revenue ie total income minus overall expenses.

To calculate reducing balance depreciation you will need to know. Written Down Value Method Formula. Also known as scrap or salvage value this is the value of the asset once it reaches the.

So in this example you would record year threes depreciation as 735. The amount of. Our property depreciation calculator helps to calculate depreciation of residential rental or nonresidential real property.

A declining balance method is a common depreciation-calculation system that involves applying the depreciation rate against the non-depreciated balance. We maximise your investment property tax depreciation saving investors money. Hence using the diminishing method calculate the depreciation expenses.

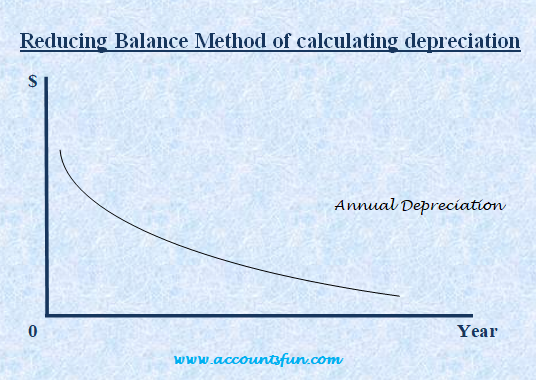

The decrease in the value of a fixed asset due to its usages over time is called depreciation. Ram purchased a Machinery costing 11000 with a useful life of 10 years and a residual value Residual Value Residual value is the estimated scrap value of an asset at the end of its lease or useful life also known as the salvage value. The Diminishing Value method accelerates the allowances in the earlier years where as the Prime Cost method evenly spreads the allowances out.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Related Topic More Assets Related Questions and Answers How to Calculate Scrap Value of an Asset with WDV Depreciation. Car bought after 19 May 2015 for 30000 ex GST Chosen calculation method.

Get 247 customer support help when you place a homework help service order with us. Diminishing Value Prime Cost. Suite 25 321 Pitt Street Sydney NSW 2000 Australia.

Calculator for depreciation at a declining balance factor of 2 200 of straight line. Depreciation expenses Net Book Value Residual Value Depreciation Rate. This lets us find the most appropriate writer for any type of assignment.

The voluminous notes to be followed do give details of how to calculate depreciation in each circumstance. Used to determine the increase or decrease in the propertys value and calculate the taxable gain or capital loss. This calculator performs calculation of depreciation according to the IRS Internal Revenue Service that related to 4562 lines 19 and 20.

When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you give such as subject area number of pages urgency and academic level. Diminishing balance or Written down value or Reducing balance Method. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

To Calculate Scrap Value of an Asset Cost of Asset Total Depreciation. 50000 x 365 365 x 200 10 50000 x 20 10000. Suppose you need to calculate the depreciation of your property.

Furthermore depreciation is a non cash expense as it does not involve any outflow of cash. Calculate depreciation of an asset using the double declining balance method and create a depreciation schedule. After 9 years scrap value 100000 90000 10000.

The book value in diminishing value depreciation method never becomes zero. Calculate Property Depreciation With Property Depreciation Calculator. Get your property depreciation reports now.

In Diminishing Method the scrap value cannot be 0. Written Down or Diminishing Balance Method. The depreciation charge is first applied to the initial cost of equipment and then to its diminished value.

It refers to the decline in the value of fixed assets due to their usage passage of time or obsolescence. The rate of depreciation is 60. How do I know the age of the property.

The value of the statement is as follows. When using the diminishing value method you would record the final years depreciation as the difference between the Net Book Value at the start of the final period here 1235 and the Salvage Value 500. Diminishing Value Method of Depreciation.

Depreciation fracCost of asset Residual valueUseful life Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100. It represents the amount of value. Declining Balance Method.

Under this method we charge a fixed percentage of depreciation on the reducing balance of the asset. Opening tax value 30000 Depreciation claimed 30000 30 9000. The template calculates the Rate of Depreciation applying the following formula.

Lets understand the same with the help of examples. If the first year is not a full 12 months and is a. This perk is named after internal revenue code.

It uses the rate of depreciation on the closing asset value of the asset. To calculate an assets adjusted tax value and the amount of depreciation to claim multiply its cost by the depreciation rate. Ensure you request for assistant if you cant find the section.

There are many depreciation methods that the entities could use. Still in the article we will discuss two depreciation methods that are normally used to calculate depreciation for the entity fixed assets and how accumulated depreciation is related to the depreciation. If an asset costs 50000 and has an effective life of 10 years your first years deduction will be.

The original value of the asset plus any additional costs required to get the asset ready for its intended use. Depreciation is a vital tool that helps small businesses take significant deductions to lower tax billsDepreciation refers to the diminishing value of an asset like real estate vehicles and office equipment. 1 Scrap ValueAsset Value 1Life Span In the end the template displays the depreciation schedule for the diminishing balance method.

Economic Value Added EVA concept. In the diminishing value method for calculating the depreciation the depreciation charge is made every year at a fixed rate on the diminished value of the equipment ie. In that case you should use an investment property depreciation calculator to get at least a.

Net Book Value INR 500000 in the first year which is equal to the cost of the car. What are the factors affecting depreciation value calculation. Diminishing Value Depreciation Method.

After filling out the order form you fill in the sign up details. Calculate your essay price. It is an internal analysis metric used by the organizations along with the accounting profits.

Depreciation is the accounting process of converting the original costs of fixed assets such as plant and machinery equipment etc into the expense. Declining Balance Method Example. This ensures that depreciation is charged in full.

The prime cost method assumes that the value of a depreciating asset decreases uniformly over its effective life while the diminishing value method assumes that the value of a depreciating asset decreases more in the early years of its effective life. Depreciation for a Period Depreciation Rate x Book Value at Beginning of the Period. There are many related factors to this deduction category with the Section 179 deduction being one of the most helpful ones.

How to calculate reducing balance depreciation.

Depreciation Formula Examples With Excel Template

Declining Balance Depreciation Calculator

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Cash Flow Statement Templates

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Methods Of Calculating Depreciation Accounting Simpler Enjoy It Method Calculator Accounting

Depreciation Rate Formula Examples How To Calculate

Depreciation Calculator

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Accumulated Depreciation Definition Formula Calculation

Depreciation Methods Principlesofaccounting Com

Depreciation Formula Examples With Excel Template

Written Down Value Method Of Depreciation Calculation

1 Free Straight Line Depreciation Calculator Embroker

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense